- No Synthetic siRNA Drug Approval Some 13 Years “A.T.” (After Tuschl)

- Alynlam Buys Sirna RNAi Assets from Merck and Forges Alliance with Genzyme

- Novartis Cuts Back on In-House RNAi Efforts

- Will RNAi for Therapeutics or for AgBio Pay-Off First?

Discovery, development and successful clinical investigations leading to new drugs are long and costly endeavors. In a detailed overview provided by The Pharmaceutical Research and Manufacturers of America (PhRMA), this process generally takes 10-15 years—at best. None of this work is cheap, and a relatively recent article in Forbes is critical of the drug industry “tossing around the $1 billion number for years.” The article digs into Big Pharma data to show that actual costs can reach $15 billion when failed drugs and all R&D are taken into account.

Having said this, it’s no surprise that seeking the first oligonucleotide drug based on RNA interference (RNAi) is still elusive today, some 13 years after Thomas Tuschl and collaborators at the Max-Planck-Institute for Biophysical Chemistry in Göttingen, Germany first reported use of synthetic 21-nucleotide RNA duplexes for RNAi. Their landmark publication in Nature in 2001, which has been cited over 9,000 times, demonstrated that these short-interfering RNA (siRNA) duplexes specifically suppressed expression of endogenous and heterologous genes in different mammalian cell lines. They presciently concluded that “21-nucleotide siRNA duplexes provide a new tool for studying gene function in mammalian cells and may eventually be used as gene-specific therapeutics.”

While siRNA did in fact become an amazingly powerful “new tool” very quickly, couching potential therapeutic utility of siRNA as an outcome that “may eventually” occur has indeed proven apropos.

Thousands of publications have led to elucidation of molecular pathways for RNAi offering various possible mechanisms of action for other types of RNAi agents. That—and delivery approaches for RNAi clinical candidates being investigated—can be read about in an excellent review by Rossi and others. The focus of this post is the elusive commercial pursuit of an RNAi drug.

Four Phases of the Business of RNAi Therapeutics

The elusive nature of RNAi therapeutics is not for lack of trying or underinvestment. According to Dirk Haussecker, ‘the business of RNAi therapeutics’ has gone through four phases, which he explores in his excellent account entitled The Business of RNAi Therapeutics in 2012. His views in that article are paraphrased as follows:

It all began with the discovery phase (2002–05), which was defined by the early adopters of RNAi as a therapeutic modality. These were small, risk-taking biotechnology companies such as Ribozyme Pharmaceuticals (aka Sirna Therapeutics), Atugen (aka Silence Therapeutics) and Protiva (aka Tekmira). As much as they may have believed in the potential of RNAi therapeutics, their strategic reorientation was also a gamble on a technology with considerable technical uncertainties in hopes of turning around declining business fortunes by leveraging their nucleic acid therapeutics know-how to become leaders in a potentially disruptive technology. This phase also saw the founding of Alnylam Pharmaceuticals—by Thomas Tuschl, Phillip Sharp (1993 Nobel Prize), and others—based on the idea of cornering the IP on the molecules that mediate RNAi so that it may finance its own drug development by collecting a toll from all those engaged in RNAi therapeutics.

Left-to-right: Craig Mello, Andrew Fire, and Alfred Nobel (taken from ambassadors.net via Bing Images).

Left-to-right: Craig Mello, Andrew Fire, and Alfred Nobel (taken from ambassadors.net via Bing Images).

Big Pharma initially saw the value of RNAi largely as a research tool only, but this quickly changed. The defining feature of this second phase—the boom phase (2005–08)—was the impending patent cliff and the hope that the technology would mature in time to soften its financial impact. A bidding war, largely for access to potentially gate-keeping RNAi IP, erupted. Most notably, Merck acquired Sirna Therapeutics for $1.1 billion, while a Roche and Alnylam alliance provided a limited platform license from Alnylam for $331 million in upfront payments and equity investment. This boom phase was also fueled by the award of a Nobel Prize to Andrew Fire and Craig Mello for their seminal discovery of double-stranded RNA (dsRNA) as the trigger of RNAi.

This period of high expectations and blockbuster deals was followed by a backlash phase (2008–2011), or buyer’s remorse, in part due to absence of adequate delivery technologies and concerns for specificity and innate immune stimulation as safety issues. Suffering from RNAi-specific scientific and credibility issues, and with first drug approvals still years away, RNAi therapeutics was among the first to feel the cost-cutting axe. The exit of Roche from in-house RNAi therapeutics development sent shockwaves through the industry. Having invested heavily in the technology only 2–3 years ago, and being considered an innovation bellwether within Big Pharma, Roche's decision in late 2010 found a number of imitators among Big Pharma and can be credited (or blamed, depending on your perspective), for intrepid investment in RNAi therapeutics ever since.

The backlash, incidentally, also had cleansing effects, many of which form the basis for the 4th and final phase, recovery (2011–present). This shift is most evident in the evolution of the RNAi therapeutics clinical pipeline that has become more and more populated with candidates based on sound scientific rationales, especially in terms of delivery approaches and anti-immunostimulatory strategies. For the recovery, however, to firmly take root and for the long-term health of the industry, it is important for the current clinical dataflow to bring back investors.

Current Status of RNAi Therapeutics

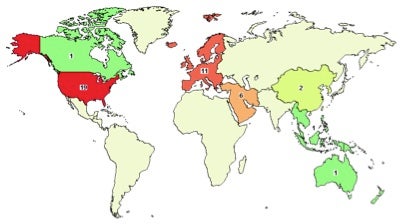

Dirk Haussecker’s The RNAi Therapeutics Blog richly chronicles the aforementioned and many more events dating back to 2007 and continuing through today. Particularly worth visiting is the Google-based World of RNAi Therapeutics map that shows current companies and—more importantly—the various RNAi agents under investigation. The screen shot below exemplifies the kind of information that is displayed when you click on any company on the map—Alnylam in this case. Very convenient indeed!

Screen shot of World of RNAi Therapeutics exemplified with selection of Alnylam from the updated list of companies in the panel on the left (taken from The RNAi Therapeutics Blog).

Screen shot of World of RNAi Therapeutics exemplified with selection of Alnylam from the updated list of companies in the panel on the left (taken from The RNAi Therapeutics Blog).

It’s worth mentioning that ClinicalTrials.gov is a web-based resource that provides patients, their family members, health care professionals, researchers, and the public with easy access to information on publicly and privately supported clinical studies on a wide range of diseases and conditions. The website is maintained by the National Library of Medicine at the National Institutes of Health. Information on ClinicalTrials.gov is provided and updated by the sponsor or principal investigator of the clinical study. Studies are generally submitted to the website (that is, registered) when they begin, and the information on the site is updated throughout the study.

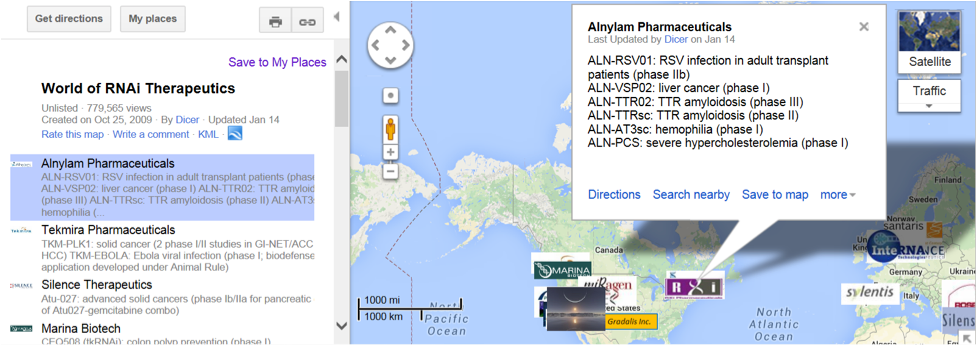

My February 2014 search of “siRNA” as a keyword at ClinicalTrials.gov found 31 studies listed. These are initially shown as a simplified list of the clinical study name and whether each study is completed, actively recruiting, active but not recruiting, terminated, etc. The list can be easily sorted by condition (i.e. disease type), sponsor/collaborators, and other parameters. Another useful feature is viewing found studies based on geographic location, as shown below. Click on any region or sub-region (i.e., state) to view information regarding studies in that area.

Alnylam Ascending

The big news for 2014 in ‘the Business of RNAi’—to borrow Dirk Haussecker’s expression—will most likely be centered around two deals involving Alnylam that were announced in January. The first announcement was that Alnylam will acquire “investigational RNAi therapeutic assets” from Merck for “future advancement through Alnylam's commitment to RNAi Therapeutics.” The acquisition of Merck's wholly owned subsidiary, Sirna Therapeutics, provides IP and RNAi assets including pre-clinical therapeutic candidates, chemistry, siRNA-conjugate and other delivery technologies.

Under the agreement, in exchange for acquiring the stock of Sirna Therapeutics, Alnylam will pay Merck an upfront payment of $175 million in cash and equity—$25 million cash and $150 million in Alnylam common stock. In addition, Merck is eligible to receive up to $105 million in developmental and sales milestone payments per product, as well as single-digit royalties, associated with the progress of certain pre-clinical candidates discovered by Merck. Merck is also eligible to receive up to $10 million in milestone payments and single-digit royalties on Alnylam products covered by Sirna Therapeutics' patent estate.

Merck’s decision was quoted to be “consistent with [Merck’s>

strategy to reduce emphasis on platform technologies and prioritize [Merck’s>

R&D efforts to focus on product candidates capable of providing unambiguous promotable advantages to patients and payers."

Alnylam expects to have six to seven genetic medicine product candidates in clinical development—including at least two programs in Phase 3 and five to six programs with human proof of concept—by the end of 2015 and referred to as "Alnylam 5x15" programs, details for which can be accessed here and in presentations.

The second announcement, which came one day after announcing the acquisition of Sirna from Merck—was that Alnylam and Genzyme would form a “transformational alliance” for RNAi therapeutics as genetic medicines. This new collaboration is “expected to accelerate and expand global product value for the RNAi therapeutic genetic medicine pipeline, including ‘Alnylam 5x15’ programs.”

Alnylam will retain product rights in North America and Western Europe, while Genzyme will obtain the right to access Alnylam's current "5x15" and future genetic medicines pipeline in the rest of the world (ROW), including global product rights for certain programs. In addition, Genzyme becomes a major Alnylam shareholder through an upfront purchase of $700 million of newly issued stock, representing an approximately 12% ownership position. This alliance significantly bolsters Alnylam's balance sheet to over $1 billion in cash that was said “to increase [Alnylam’s>

investment in new RNAi therapeutic programs, while securing a cash runway that [Alnylam>

believes will allow [it>

to develop and launch multiple products as breakthrough medicines.”

In addition to the upfront equity purchase, Alnylam will receive R&D funding, starting on January 1, 2015, for programs where Genzyme has elected to opt-in for development and commercialization. In addition, Alnylam is eligible to receive milestones totaling up to $75 million per product for regional and co-developed/co-promoted programs. In the case of global Genzyme programs, Alnylam is eligible to receive up to $200 million in milestones per product. Finally, Alnylam is also eligible to receive tiered double-digit royalties up to 20% on net sales on all products commercialized by Genzyme in its territories. In the case of Genzyme's co-developed/co-promoted products in the Alnylam territory, the parties will share profits equally and Alnylam will book net sales revenues.

Those interested in a “deep dive” into Alnylam’s impressive array of other strategic alliances can find lead information here.

First RNAi Drug Approval on the Horizon

Hopefully, the ‘Business of RNAi’ is entering its 5th phase: drug approval for sale, which would—finally—provide long-awaited demonstration of clinical utility and commercial payback toward huge investments to date.

In this regard, Alnylam has recently begun recruiting patients for a pivotal Phase III clinical trial that could lead to the first RNAi drug approval in the near future. This comes shortly after Alnylam’s November 2013 here. Results showed that multiple doses of a Tekmira Phamaceuticals lipid nanoparticle formulation of ALN-TTR02 led to robust and statistically significant knockdown of serum TTR protein levels of up to 96%, with mean levels of TTR knockdown exceeding 85%. Knockdown of TTR, the disease-causing protein in ATTR, was found to be rapid, dose dependent, and durable, and similar activity was observed toward both wild-type and mutant protein. In addition, ALN-TTR02 was found to be generally safe and well tolerated in this study.

Details for the Phase III multicenter, multinational, randomized, double-blind, placebo-controlled study to evaluate the efficacy and safety of ALN-TTR02 can be read here at ClinicalTrials.gov. Among the details are the following facts, including the targeted completion date. While the trials look promising so far, January 2017 is several years away, and it’s wise to “never count your chickens before they hatch.”

| Estimated Enrollment: | 200 |

| Study Start Date: | November 2013 |

| Estimated Study Completion Date: | May 2017 |

| Estimated Primary Completion Date: | January 2017 (Final data collection date for primary outcome measure) |

Novartis Cuts Back Its In-House RNAi R&D

While investment in RNAi at Alnylam is ascending, the situation at Novartis is descending, based on an article in GenomeWeb in April of 2014 stating that Novartis will be cutting back its 26 person effort. The article adds that, according to a Novartis spokesperson, the decision was driven by "ongoing challenges with formulation and delivery and the reality that the current range of medically relevant targets where siRNA may be used is quite narrow."

Despite its decision to dial down its RNAi programs, Novartis still holds onto the rights to use Alnylam's technology against the 31 targets covered under their one-time partnership, the company spokesperson said.

And as work continues on those targets, albeit by a downsized research team, Novartis will also considering partnering opportunities in the space, the spokesperson added.

With the seemingly never ending challenges of formulation and delivery, perhaps RNAi will pay-off first in the agricultural biotechnology (aka AgBio) space, as briefly discussed in the next section.

Pros and Cons of RNAi for AgBio

RNAi can be achieved using genetically encoded sequences rather than using chemically synthesized siRNA duplexes or other types of synthetic oligonucleotides. Agricultural biotechnology has already taken advantage of such genetically engineered constructs in producing stable and heritable RNAi phenotype in plant stocks. Analogous procedures can be applied to other organisms—including humans, such as in antiviral stratagems against HIV-1.

Andrew Pollack recently reported in the New York Times that agricultural biotechnology companies are investigating RNAi as a possible approach to kill crop-damaging insects and pathogens by disabling their genes. By zeroing in on a genetic sequence unique to one species, the technique has the potential to kill a pest without harming beneficial insects. That would be a big advance over chemical pesticides.

Subba Reddy Palli, an entomologist at the University of Kentucky who is researching the technology, is quoted as saying “if you use a neuro-poison, it kills everything, but this one is very target-specific.”

Some specialists, however, fear that releasing gene-silencing agents into fields could harm beneficial insects, especially among organisms that have a common genetic makeup, and possibly even endanger human health. Pollack adds that this controversy echoes the larger debate over genetically modified crops, which has been raging for years. The Environmental Protection Agency (EPA), which regulates pesticides, is meeting with scientific advisers to discuss the potential risks of RNA interference.

RNAi May Be a Bee’s Best Friend

In addition to use in AgBio, RNAi may prove useful in reviving bee populations. RNAi is of interest to beekeepers because one possible use, under development by Monsanto, is to kill a mite that is believed to be at least partly responsible for the mass die-offs of honeybees in recent years.

In opposition to this, the National Honey Bee Advisory Board is quoted as saying “to attempt to use this technology at this current stage of understanding would be more naïve than our use of DDT in the 1950s.”

Pollack reports that some bee specialists told the EPA that they would welcome attempts to use RNAi to save honeybees, and groups representing corn, soybean and cotton farmers also support the technology: “commercial RNAi technology brings U.S. agriculture into an entirely new generation of tools holding great promise,” the National Corn Growers Association said.

Corn Growers Need a New Tool

For a decade, corn growners have been combating the rootworm, one of the costliest of agricultural pests, by planting so-called BT crops, which are genetically engineered to produce a toxin that kills the insects when they eat the crop. Or at least the toxin is supposed to kill them. Rootworms are now evolving resistance to at least one BT toxin.

Given that rootworm larvae can destroy significant percentages of corn if left untreated, a robust alternative is crucial to protecting future corn crops. Current estimates in the US indicate as much as 40% of corn acreage is infested with corn rootworms and the area is expected to grow over the next 20 years. RNAi is now is being studied as a possible alternative to BT toxins, and Monsanto has applied for regulatory approval of corn that is genetically engineered to use RNAi to kill the western corn rootworm.

Personally, I’m not completely averse to RNAi for AgBio, especially in view of the need to adequately feed the world’s growing population. Careful regulatory scrutiny, even if it results in slow moving progress, seems wise in order to avoid unintended consequences that could be very problematic.

As usual, your comments are welcomed.